The New York City real estate market is notorious for its soaring prices and volatility – as far as availability goes. It isn’t practical to begin a search for an apartment 6 months in advance because that inventory will be long gone by the time you actually plan on signing a lease and moving. Many people have an ideal home, but being dead set on that one type of apartment will greatly limit your options.

One criteria that will significantly limit your search is only searching for condos. About 25% of the market consists of condos while the other 75% is made up of co-ops. Although the co-op board interview and application process may seem intimidating, it can be well worth considering a co-op.

What is a co-op?

A co-op is a building in which you don’t own the property itself. If you buy a condo, you get the deed (once you’ve paid off your mortgage) and you personally own the unit. With co-ops, you are not buying the property, but instead buying shares of the corporation, more similar to an investor than a property owner. How much of the corporation you own is based on the size and desirability of the unit.

Because it is a “cooperative,” decisions are voted on by the co-op board and that ideally creates a more communal and democratic system of making decisions. However, unlike a condo, residents do not have the freedom to make changes within the unit walls (painting, carpeting, etc.) because they do not technically own the unit itself.

Most units in new developments are sold as condominiums, so the ratio of co-op to condo is decreasing. Most pre-war units are co-ops, so if you’re 100% set on a pre-war apartment, a co-op is probably the way to go.

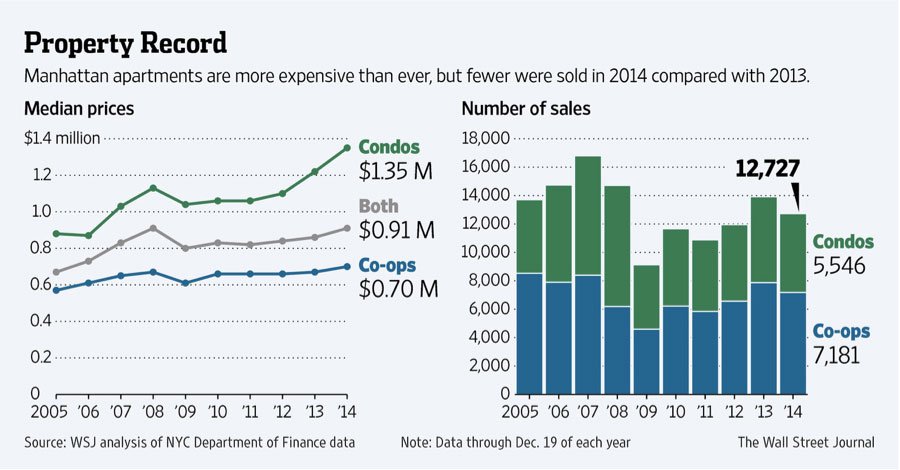

According to Streeteasy, the median market sales price at the end of 2014 was $942,000 while the median sales price was about $1.43M for condos and $683,000 for co-ops. The Wall Street Journal shows the consistent price difference between condos and co-ops over time with data taken from the New York City Department of Finance.

Pros of Buying a Co-op

Co-ops are often cheaper than condos by up to 40% less. Note that this is the just with respect to the sales price, not the various costs associated with the entire purchase.

There is also a great turnaround time for getting things fixed in the building, as many co-ops have live in supers. The monthly maintenance fee goes towards various projects such as repairs, so a broken heater is guaranteed to be fixed – probably quickly.

There are no property taxes – well, not on paper. You’ll still be paying “taxes,” but as part of the monthly maintenance fee. Technically, the corporation is responsible for taxes, but all of the residents contribute their share.

There is also a greater sense of community, so if you get approved because you’re a good fit, you’re probably more likely to be aware of who your neighbors are. There’s a more selective process to maintain a certain type of community within a co-op, so it could work to your advantage.

If you’re looking to live in a quiet building free of screaming children, barking dogs, or aspiring music artists banging on instruments throughout the night, there’s a co-op that exists that makes sure none of its residents will be bringing any of the aforementioned qualities to the living space.

Cons of Buying a Co-op

Although co-ops are often cheaper than condos, they do require a large down payment up front. Most co-ops will ask for a 20% down payment, but some will ask for 40%.

There is also a higher monthly maintenance fee. It covers repairs, insurance, maintenance, and taxes. These costs are distributed among the residents. It is possible that you will be unhappy with some of the decisions made. The majority of the board may decide that they wish to funnel some of the monthly maintenance fee money towards fresh flowers in the lobby while you think those funds would be better utilized elsewhere. But that’s how democracy works. Consequently, the board would naturally want to approve new residents with similar desires.

Co-ops have strict regulations on selling and subletting. You cannot sell your share to just anyone. Both buyers and individuals looking for a short-term sublet will need to be approved by the board. It is also possible that subletting is not allowed at all.

Why Do People Rule Out Co-ops?

It is a much more intensive process to apply and get approved for a co-op. When purchasing a condo, you need to prove that you are capable of affording the property. You choose what documentation to show in addition to the basics. You must provide income information, but you decide which assets to include and show. You have less of a choice when it comes to a co-op and must provide a much more comprehensive financial picture. And of course, there’s the dreaded interview.

There is less freedom, as the regulations for co-ops are stricter – and often more extensive – than those of condos. It’s a very different vibe to live in a co-op than a condo, and each co-op has its own unique personality.

Considering a Co-op?

If the qualities above appeal to you, it wouldn’t hurt to apply for a co-op. Though most people would try to avoid working with a broker, an agent you could be an immense help navigating through the application and approval process. They can help package you in the most desirable way possible and give you tips or nailing a board interview.

It may seem daunting to try to find your dream home in a real estate market as aggressive as the one in NYC, but keeping an open mind means having a larger inventory to choose from and it will increase your chances of finding the apartment.